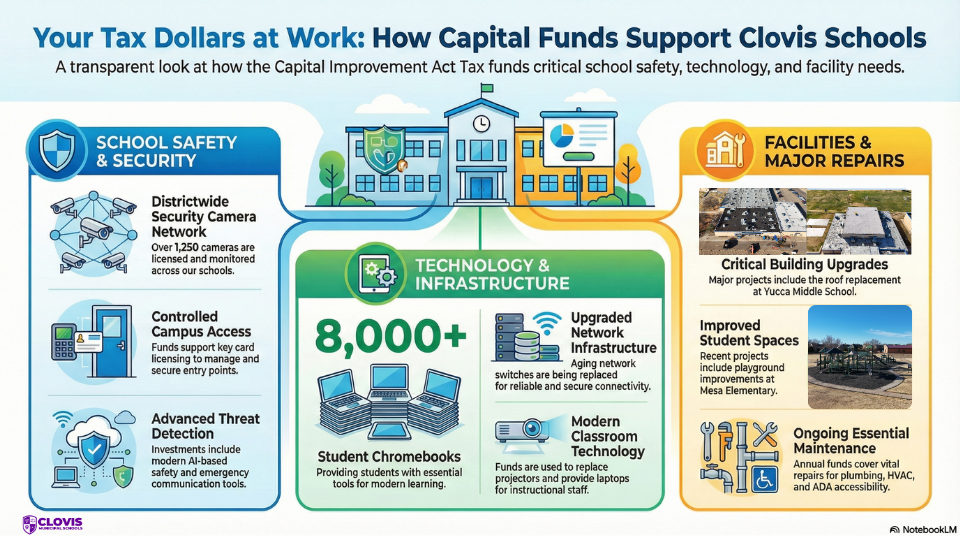

As our community prepares for an upcoming special election related to the Capital Improvement Act Tax, we want to take time to clearly and transparently share how these funds have been used across Clovis Municipal Schools.

The Capital Improvement Act Tax is dedicated to supporting the maintenance, safety, and infrastructure needs of our schools. These funds do not support salaries or curriculum. Instead, they help ensure our buildings remain safe, functional, and equipped to support teaching and learning every day.

How Capital Improvement Act Funds Are Used

School Safety and Security

Capital Improvement Act funds play a critical role in supporting campus safety systems, including:

Key card access licensing to help manage secure entry points

Districtwide camera systems and licenses covering approximately 1,250 cameras

Advanced safety technology such as AI-based threat detection and emergency communication tools

These investments support ongoing monitoring, coordination, and response capabilities across the district.

Technology Infrastructure

Reliable technology infrastructure is essential for daily operations and learning. Funds have supported:

Replacement of aging network switches across campuses, including access and core switches

More than 8,000 student Chromebooks

Laptops for instructional and support staff

Replacement of classroom projectors

These upgrades help ensure secure connectivity, instructional access, and system reliability districtwide.

Facilities and Major Repairs

Capital Improvement Act funds also support major facility needs that cannot be delayed without impacting school operations, including:

Roof replacement at Yucca Middle School

HVAC improvements at The Rock

Playground improvements at Mesa Elementary

In addition to these larger projects, funds are used each year for routine maintenance such as roof repairs, plumbing and HVAC work, ADA accessibility updates, and other critical building systems.

Why This Matters

Unlike large state-funded construction projects, which are limited and competitive, the Capital Improvement Act Tax provides local, recurring funding that allows the district to address urgent maintenance needs as they arise. Without this funding source, districts must redirect operational dollars currently spent on student-focused programs to cover basic facility needs.

Our goal is to ensure families, staff, and community members have clear, accurate information as they consider this ballot question. We remain committed to transparency, responsible stewardship of public funds, and maintaining safe, functional learning environments for our students.

Thank you for taking the time to stay informed and engaged in the future of our schools.

If you have a question regarding the Capital Improvement Act Tax, please visit our Capital Improvement Act Tax webpage to view the answers to frequently asked questions.

Don't see your question listed? Submit your question, here.